Complete Logo & Brand Identity Design

Responsive Website Design

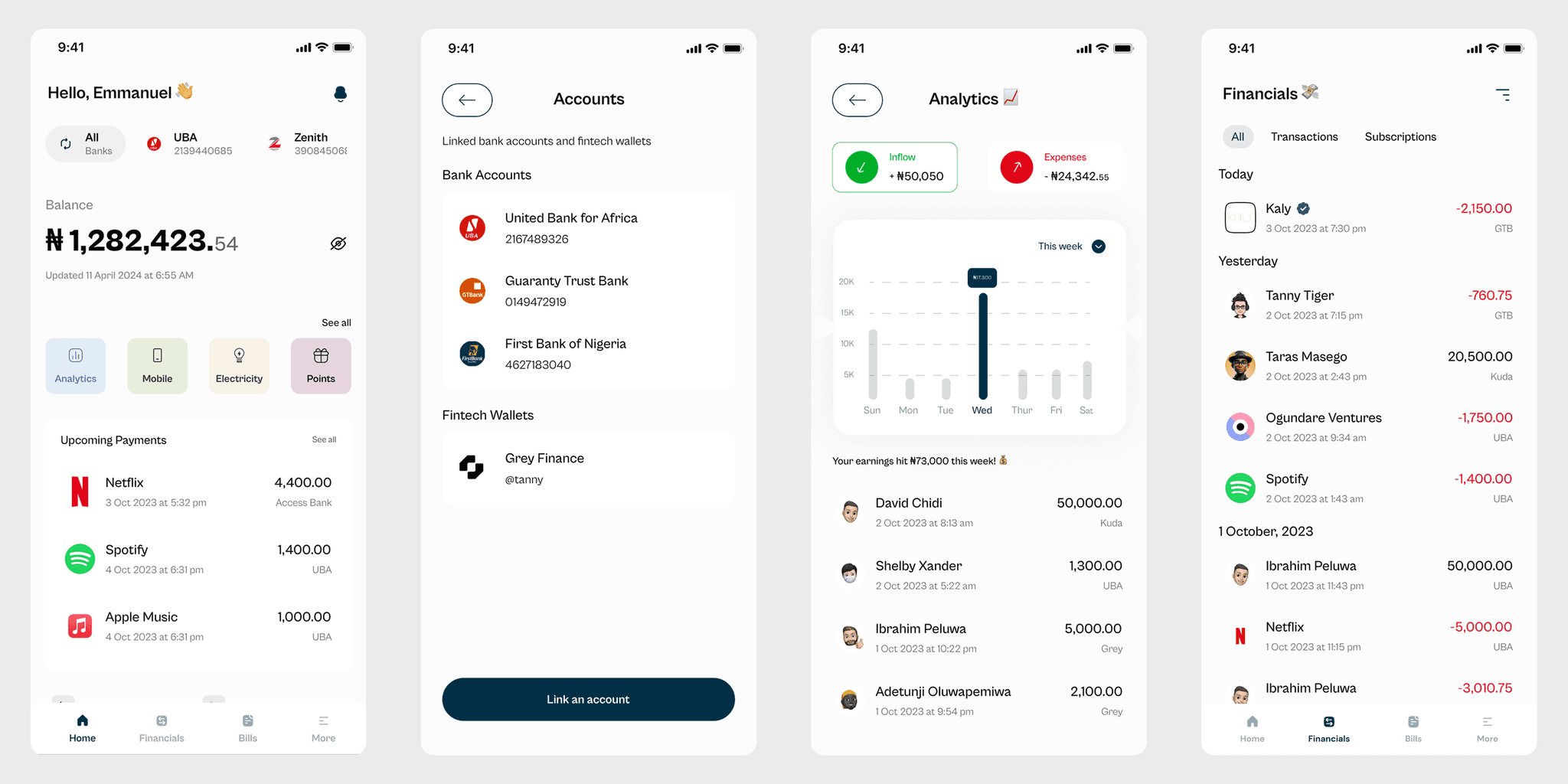

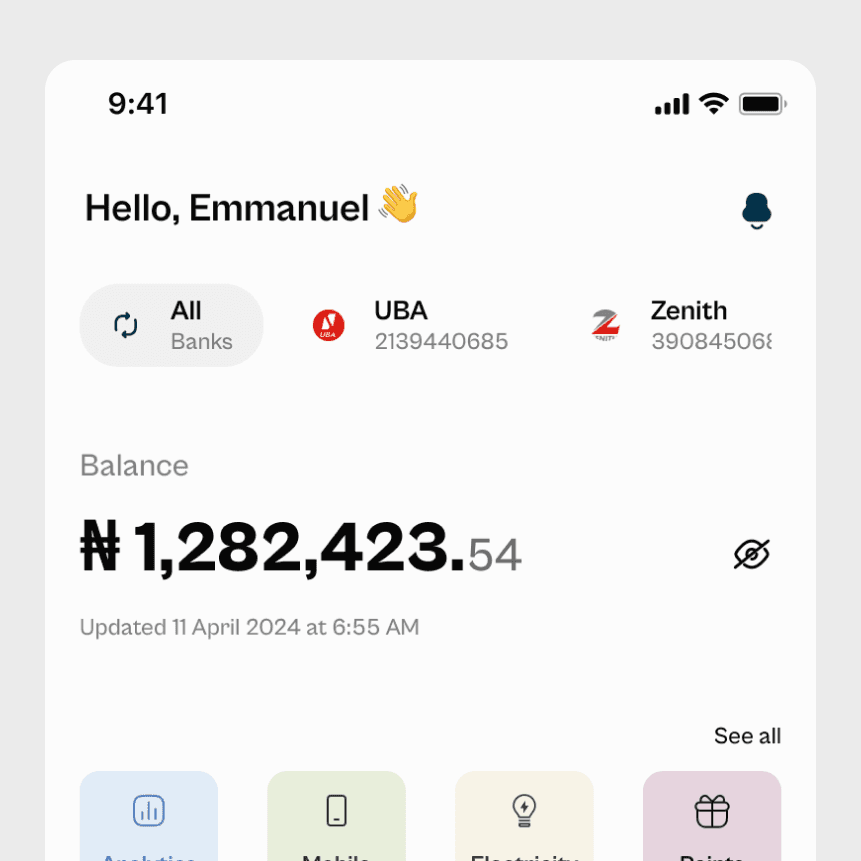

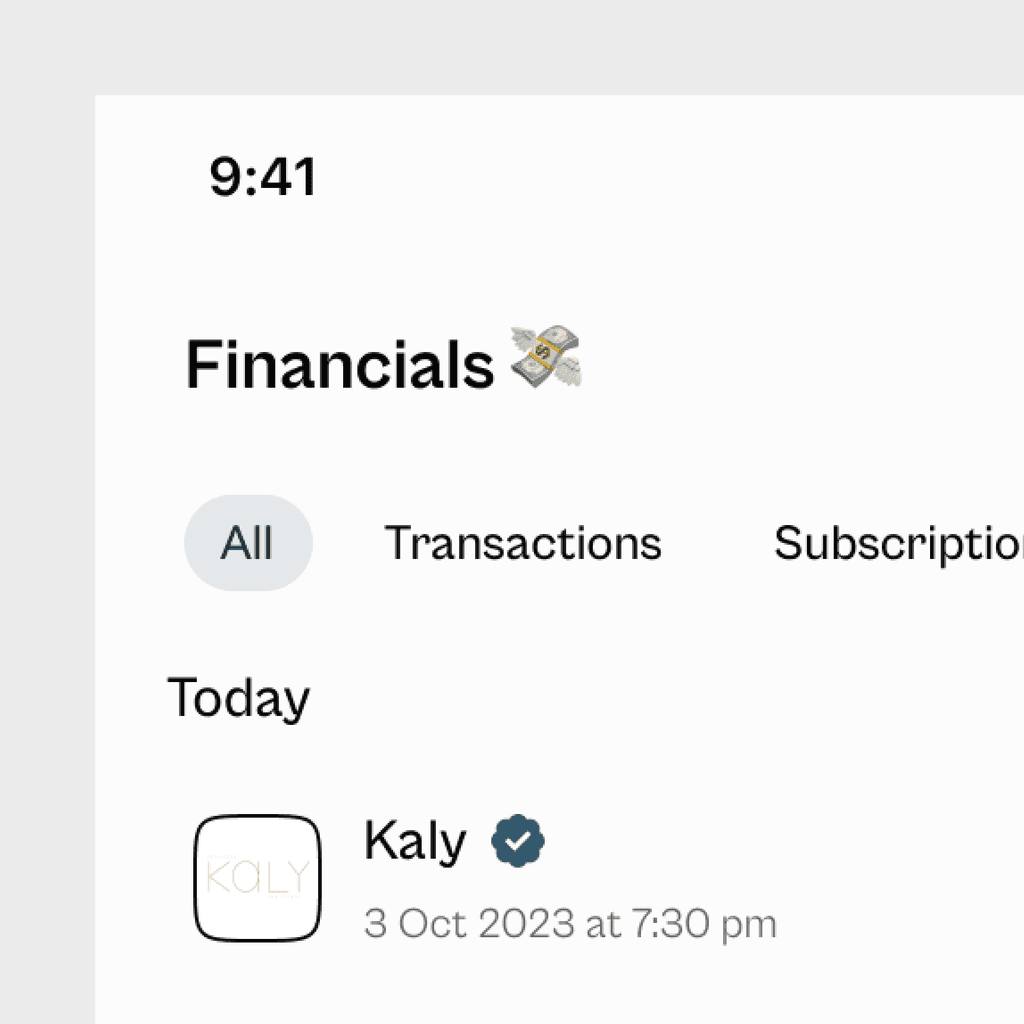

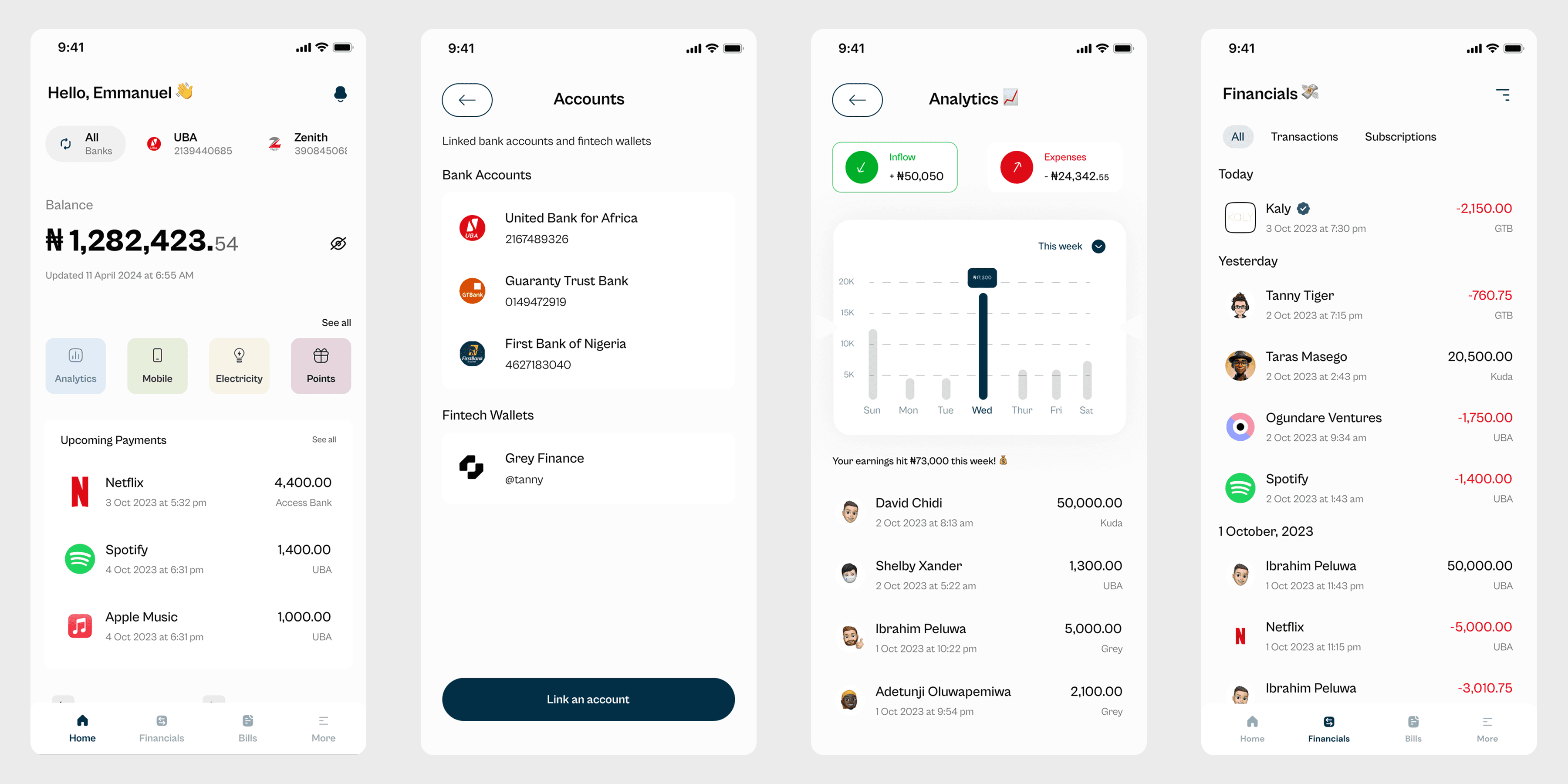

Comprehensive Product Design for Mobile App MVP

Duration

Platform Focus

Team Structure

Lead Designer (Me): Research, UX/UI Design, Prototyping, Developer Handoff

Product Designers (Olamide & Ada)

Backend (Peluwa) and Frontend Developers (Jonathan)

Role & Responsibilities

Tools & Technologies

Design & Prototyping: Figma

Documentation: Notion

Collaboration: Slack, WhatsApp

The Challenge: Navigating Financial Overwhelm

In Nigeria, managing finances is a significant source of stress. Users struggle with:

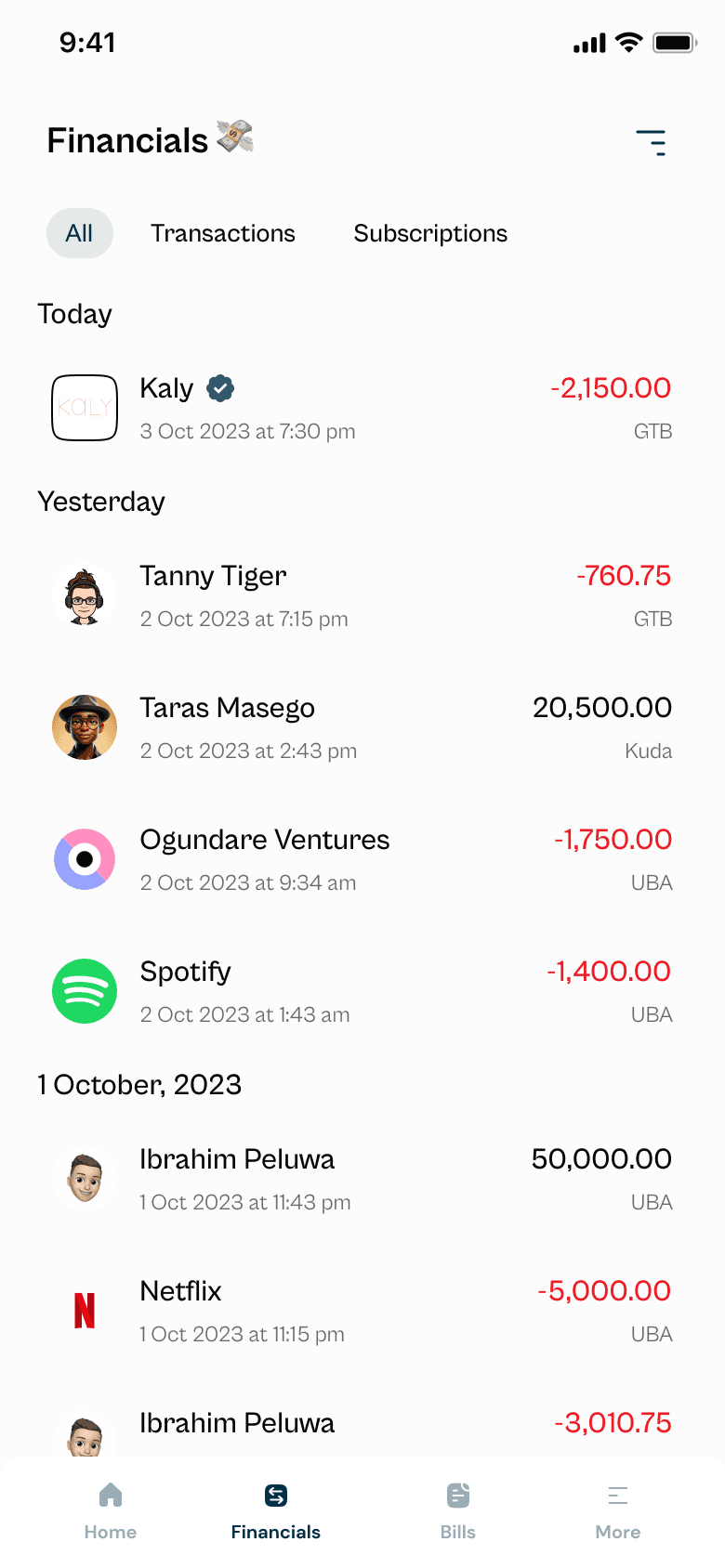

Complex financial lives with multiple income streams, recurring payments, and a lack of centralized tracking tools.

Late fees and financial stress caused by poor tracking of due dates and recurring bills.

Time-consuming, error-prone manual tracking with limited insights into spending habits.

Absence of tools to understand spending patterns and make informed decisions.

Research & Insights: Understanding the Problem

Approach

Conducted 15 user interviews to understand financial habits, pain points, and expectations.

Performed a competitive analysis of financial management apps like Trakka and Inflow.

Mapped detailed user journeys for tasks like tracking expenses, paying bills, and managing subscriptions.

Key Insights

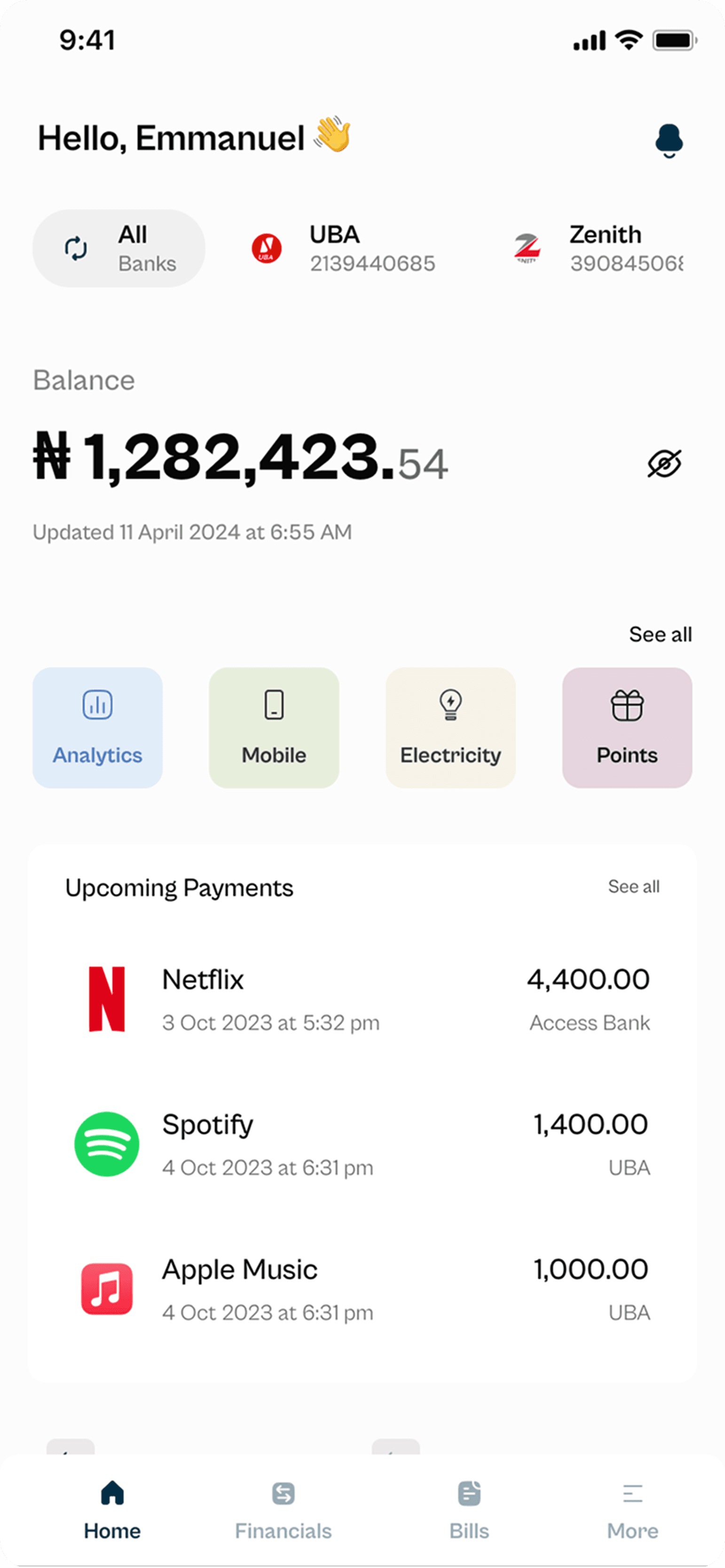

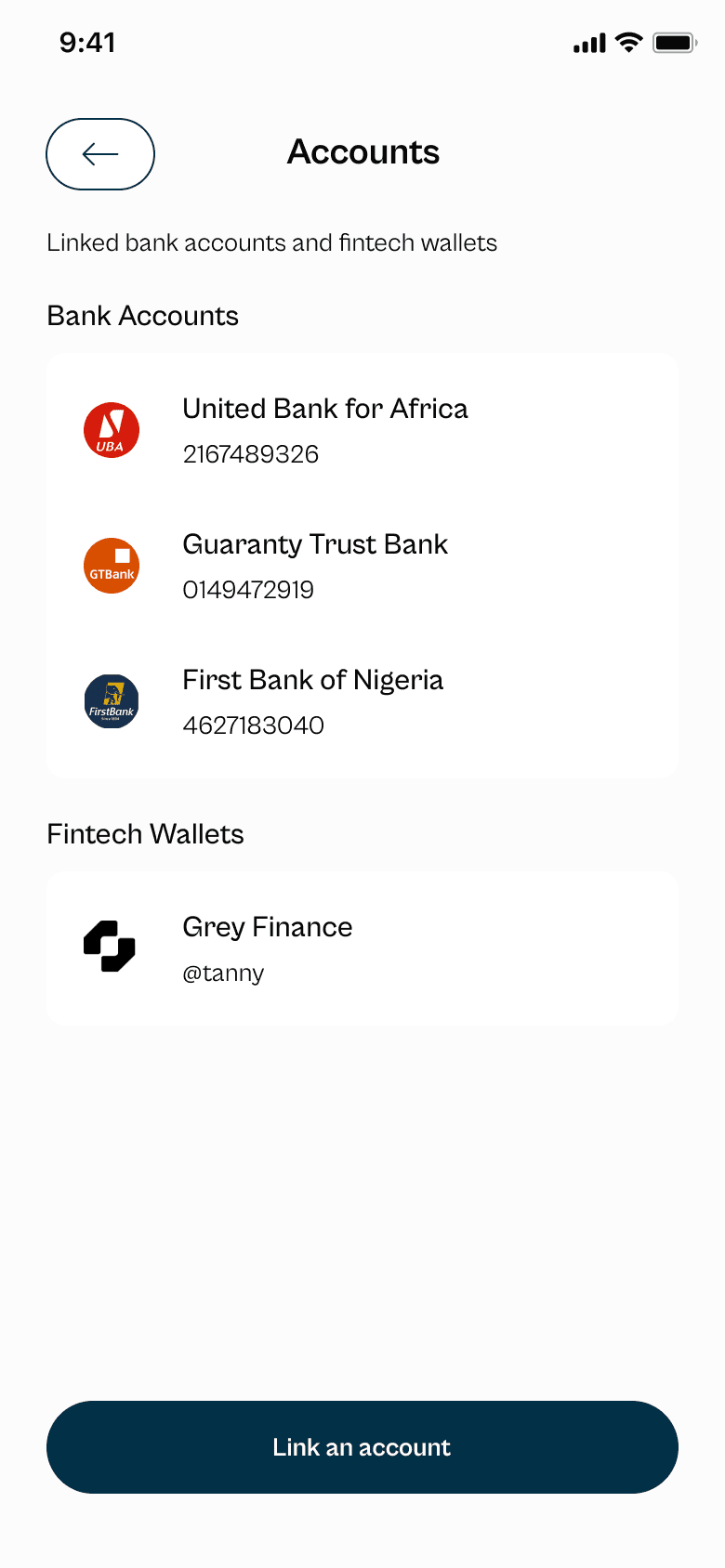

Users want a centralized platform for financial consolidation.

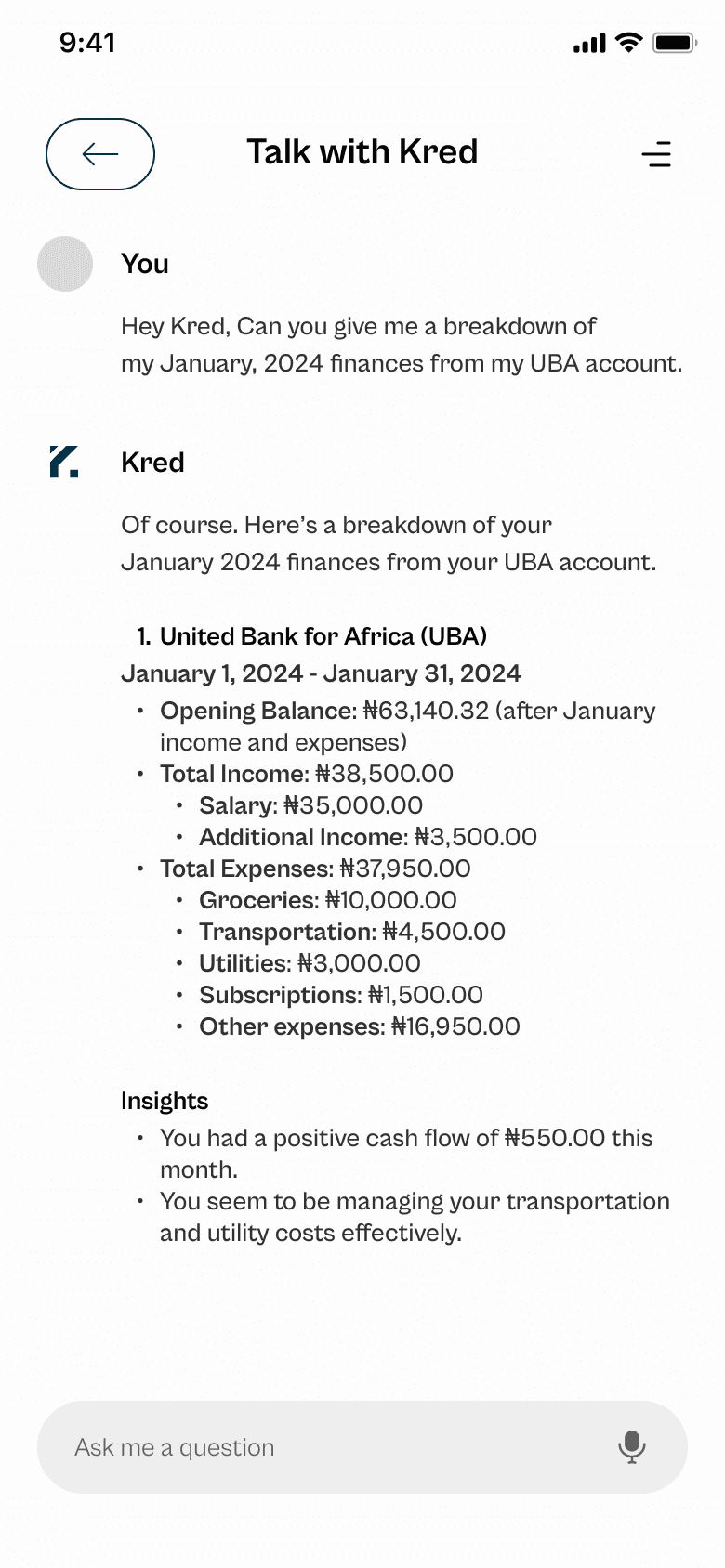

Tools should offer tailored advice and insights.

Data privacy is critical for user adoption.

Design Process: Designing the Solution around the User

I created personas reflecting the diverse financial challenges of Nigerian users, such as "Ayo," a small business owner juggling personal and professional expenses.

2. Information Architecture

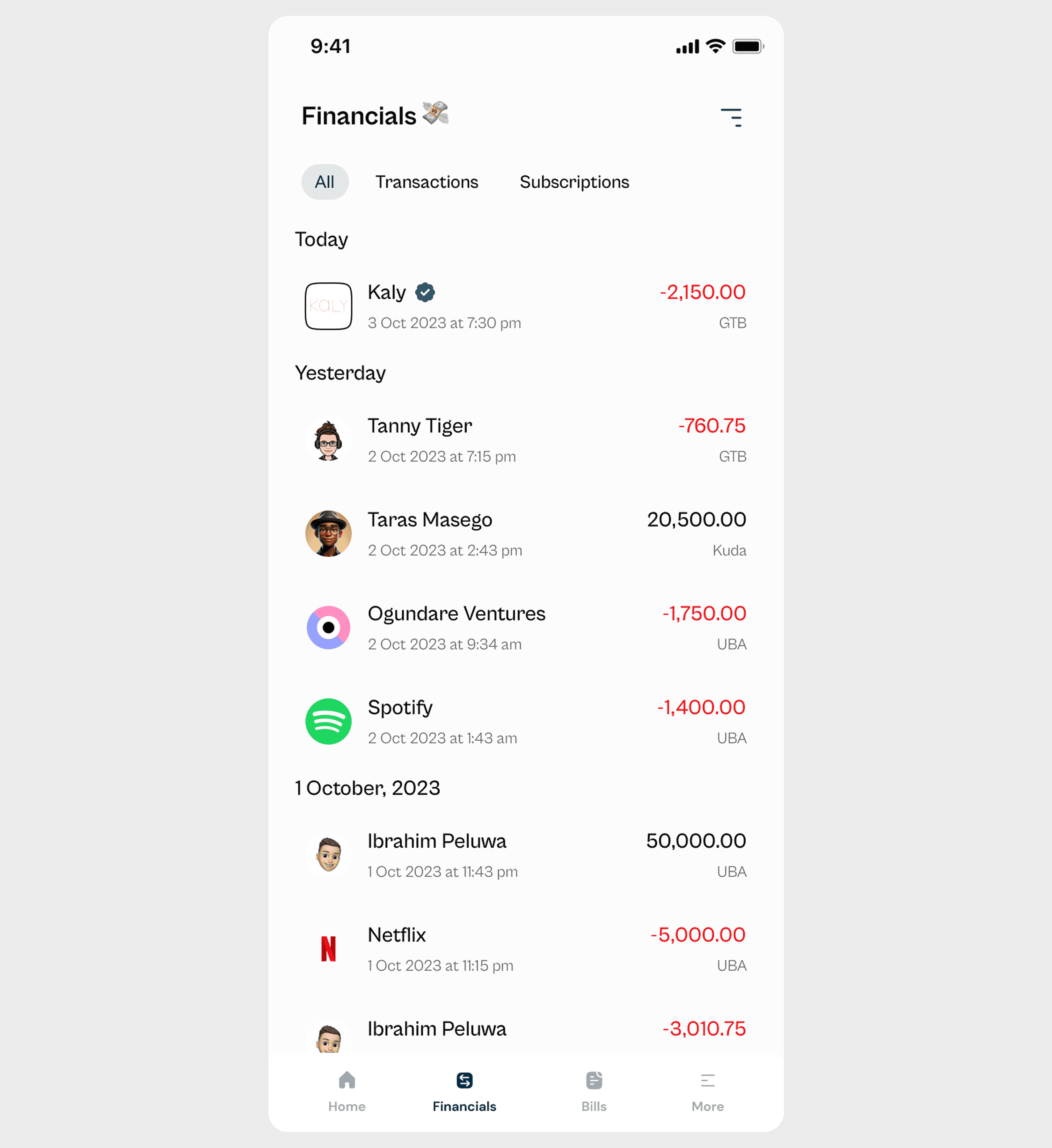

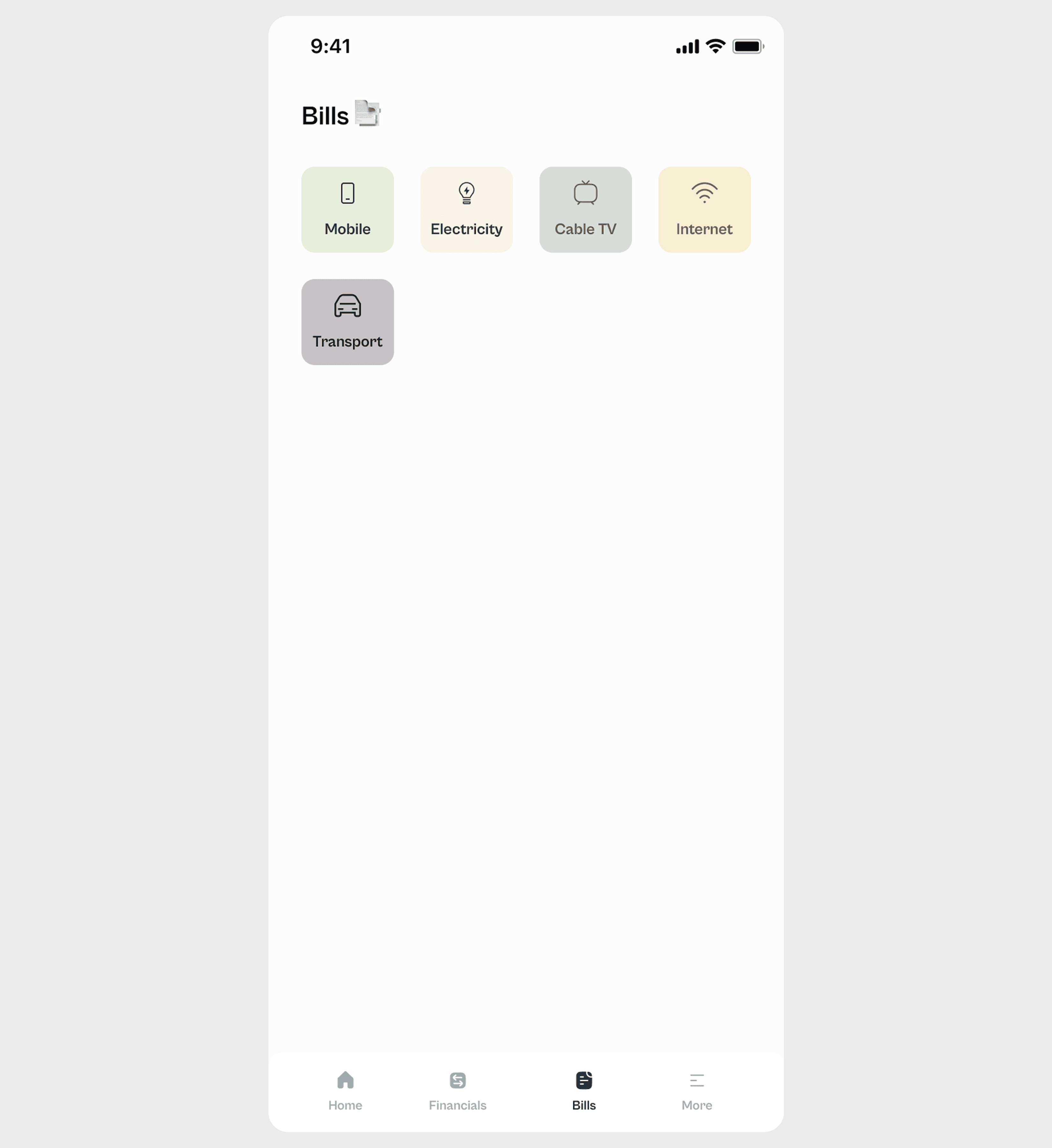

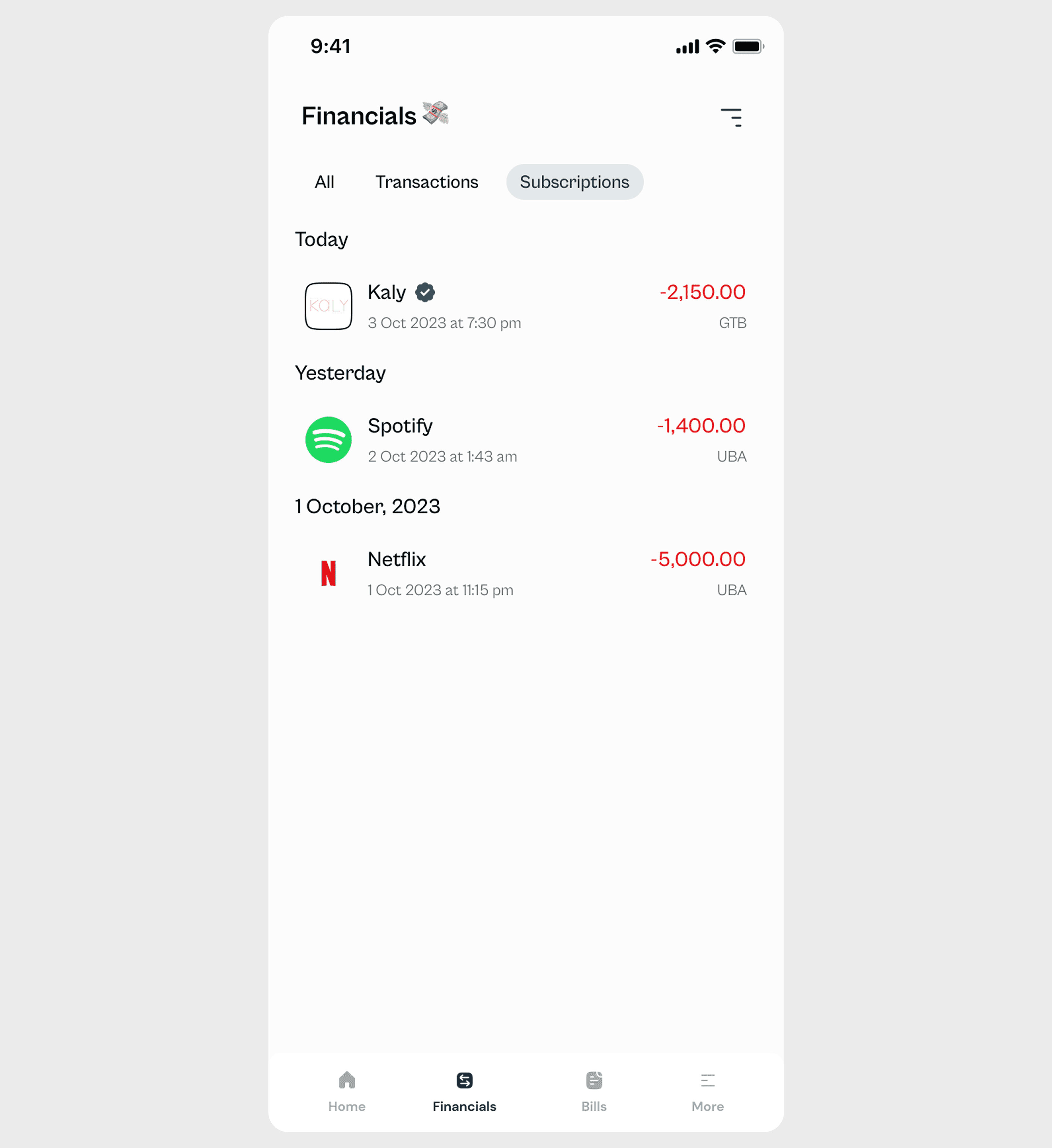

The app’s structure prioritized discoverability and intuitive navigation, ensuring users could easily locate essential features like transaction history or subscription tracking.

Detailed user flows outlined tasks such as:

Adding transactions

Setting bill reminders

Managing subscriptions

Low-fidelity wireframes established the foundational layout.

Iterated on high-fidelity prototypes, focusing on accessibility and clarity.

5. Usability Testing

Conducted usability tests with 5 users, refining features based on feedback.

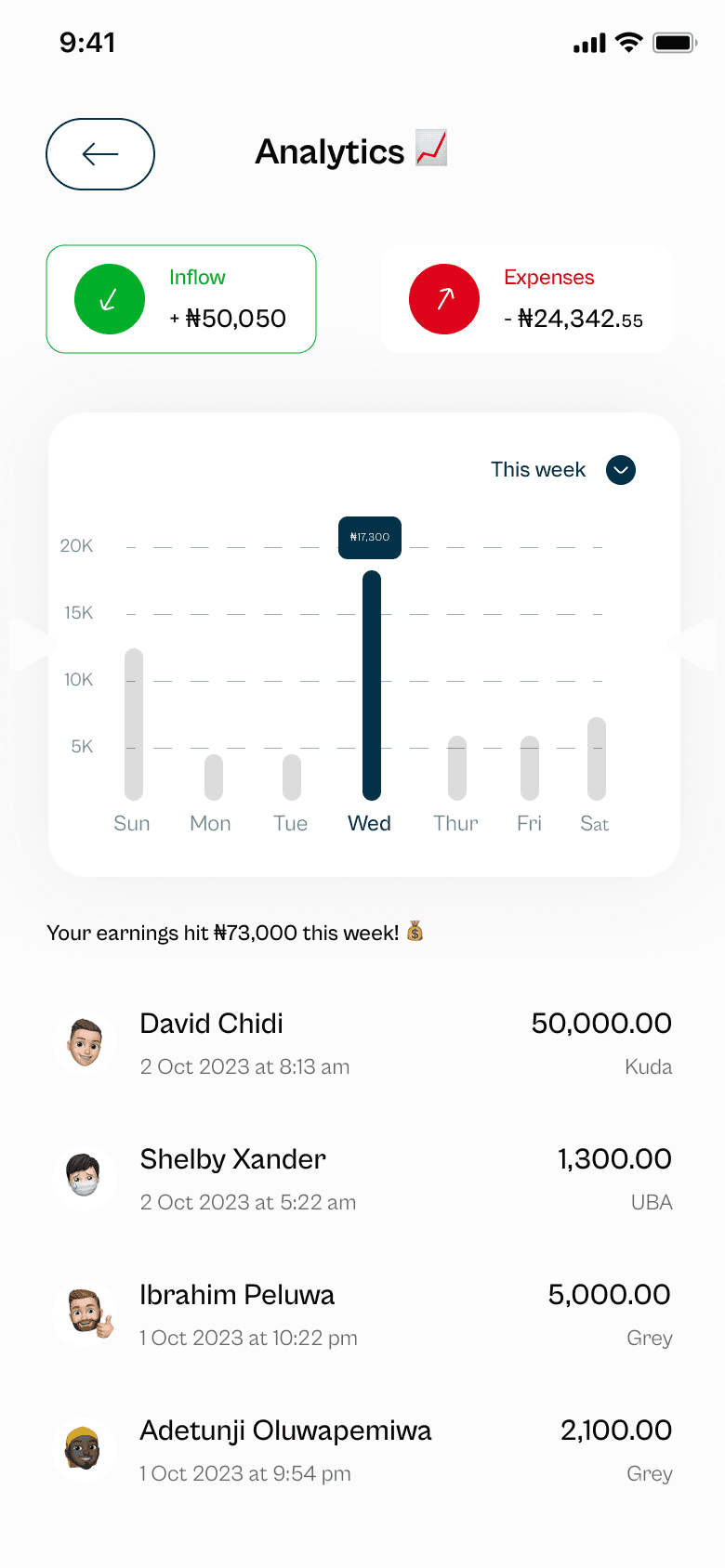

Key Features

Automatic bank linking for seamless imports.

AI-powered categorization for quick insights.

Centralized dashboard displaying due dates.

Payment reminders and auto-scheduling for recurring bills.

Detection of automatic renewals.

Alerts for expiring subscriptions.

Interactive map interface

Status updates

ETA calculations

Multiple payment options

Wallet integration

Transaction history

In-app chat

Quick response times

Issue resolution tracking

Impact & Results

30% improvement in financial literacy as users reported better spending awareness.

45% reduction in late payment fees due to bill reminders.

70% user retention after two months of beta testing.

50% app download growth in Q1.

40% reduction in customer support queries, saving resources.

Elevated market position with a user-centered approach.

Overcoming Challenges

Solution: Progressive disclosure to surface essential data first.

Solution: Collaboration with engineers to optimize refresh rates and rendering.

Lessons Learned

Empathy drives impactful design.

Collaboration bridges design and technical constraints.

Visual design simplifies complexity.

Conclusion

This project transformed a personal pain point into a market-leading feature that improved currency monitoring. By balancing user empathy, visual design, and technical collaboration, I achieved a solution that simplifies financial decisions for millions.